Fusion’s specialist insurance and innovation contribute to building a sustainable future

Power of Purpose

We support clients who are contributing to the global imperative of building a sustainable future.

We operate at the intersection of insurance, Environmental, Social and Corporate Governance (“ESG”) and technology to deliver personalised protections, focusing on transactions, Insureds and Partners that in turn support sustainability.

Fusion has a commitment to being a responsible company and is an early mover in systemic integration of environmental, social and governance (“ESG”) criteria in its underwriting decisions.

Fusion’s Sustainable Insurance delivers protections and innovation tailored for the following areas:

Sustainable Finance Insurance

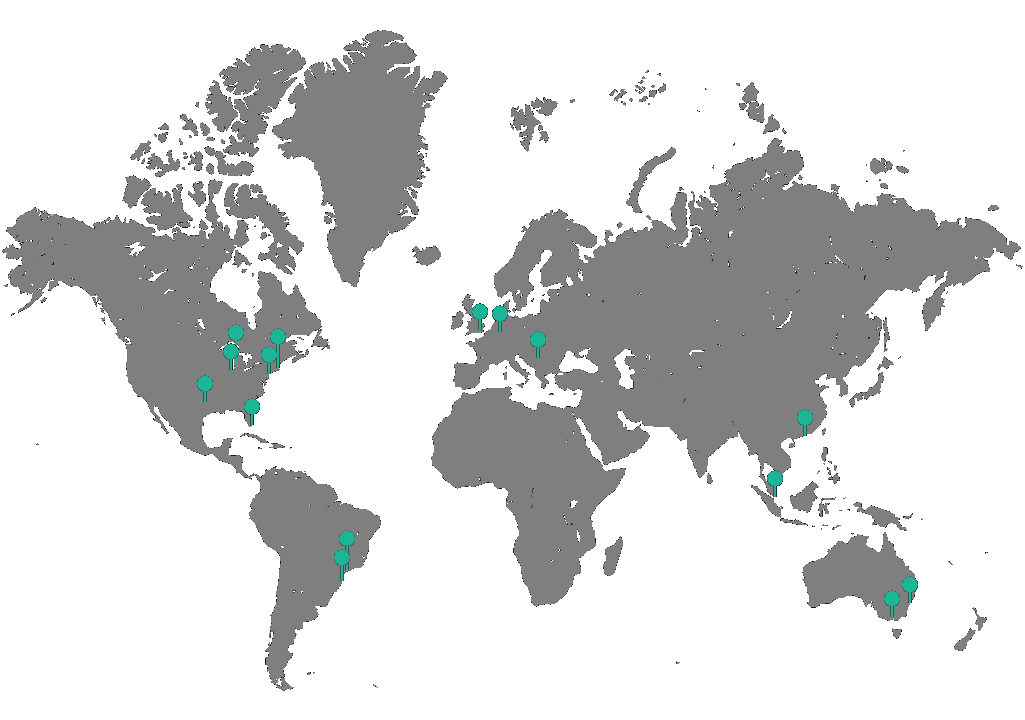

Fusion is the world’s first sustainable Warranties & Indemnities (“W&I”) insurer. We support M&A transactions whose counter-parties / target companies are advancing ESG and contributing to sustainability.

Fusion’s new and diversified insurance products will meet the risk financing needs of a greener economy. At the end of 2020, over $40tn of assets globally were invested in ESG-aligned and sustainable impact strategies, nearly double the amount invested just four years earlier.

We also deliver Investment Managers Insurance for Investors who are focused on green / sustainable investments.

Innovation & Digitalisation

Fusion, in partnership with our related companies io.insure and POPai, have built a global SME M&A Insurance Marketplace with the purpose of filling the large global risk protection gap in the under or unserved SME M&A transactions segment. This Marketplace is also offering other specialty insurances such as Financial Lines for ESG compliant companies.

We are innovators that are assisting in the digitalisation and democratisation of insurance. In doing so, we are creating sustainable insurance products that are more cost effective, affordable, efficient and inclusive.

io.insure and its sister company POPai apply smart analytics to enhance risk knowledge, risk prevention, pricing accuracy and the customer experience.

We also offer W&I, Directors & Officers, Employment Practices Liability and Professional Liability insurance protections for data and technology innovators.

Sustainable Energy Insurance

We provide W&I, Directors & Officers, Employment Practices Liability and Professional Liability insurance protections for the renewable energy sector, and specifically companies / projects that are advancing energy transition and energy efficiency.

Decarbonisation

We support the transition to a low-carbon economy through excluding thermal coal, oil sands and oil shale sector risks.

How it works in practice?

Embed

Initial Assessment

Underwriting

Pricing

Coverage

Insurer Partners

Carbon Neutral

Embed

We have embedded sustainability and innovation in our products, services, operations and business practices. This is inspired by the UN Sustainable Development Goals.

Initial Assessment

Before underwriting and providing coverage, we conduct ESG checks, including detailed sanctions and reputation checks, based on industry sectors and sensitive countries lists. Fusion will not provide coverage unless these assessments result in a clearance to proceed.

Underwriting

Fusion’s risk assessments for W&I and Financial Lines insurances include a focus on clear evidence of good governance and compliance with laws, including environmental laws. We adopt a unique underwriting approach based on data, technology and proprietary ESG criteria. We assess the Insured’s ESG strategies, actions taken and achievements. For M&A transactions, we assess the scope and quality of disclosure on the part of the Seller and the adequacy due diligence performed by the Buyer and their advisors in respect of sustainability / ESG. We have also embedded this in our online and offline insurance questionnaires.

Pricing

Fusion’s pricing model applies more competitive rates for insureds that are compliant with ESG standards and contributing to a sustainable future. Empirical studies evidence a persistently strong correlation between corporates with advanced ESG credentials and low insurance claims, enabling Fusion to offer better terms.

Coverage

Consistent with the above, the scope and breadth of coverage we offer to Insureds in the Fusion policies is also strongly correlated with the quality the Insured’s sustainability strategy and its effective execution.

Insurer Partners

Fusion underwrites its sustainable insurance on behalf of global and local Insurers, who in turn embed multiple instruments to integrate ESG considerations into their underwriting activities and aim to lead by integrating ESG factors into their risk management, underwriting and investment practices. Fusion assesses its Insurer Partners’ ESG strategies prior to entering into agreements with them. On doing so, we operate collaboratively with our Insurer Partners in contributing to sustainability.

Carbon Neutral

Fusion’s ambition is to become a carbon neutral insurance business.